Financial Tricks Roarleveraging the Best Investment Strategies for 2025

As investors prepare for the evolving landscape of 2025, understanding asset allocation and diversification becomes crucial. The focus on emerging sectors, particularly green technology and digital health, presents unique opportunities. However, with these opportunities come inherent risks that demand tactical management. Analyzing these strategies will reveal how investors can craft resilient portfolios that not only withstand market fluctuations but also capitalize on growth potential. What strategies will emerge as most effective in this dynamic environment?

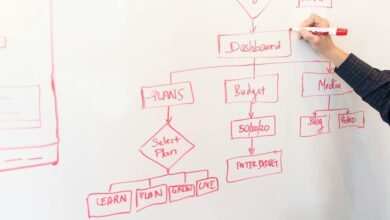

Smart Asset Allocation Strategies

Effective asset allocation is crucial for optimizing investment returns while managing risk. By constructing diversified portfolios, investors can spread exposure across various asset classes, reducing vulnerability to market fluctuations.

Strategic rebalancing ensures that these portfolios maintain their intended risk-return profile over time, allowing for adjustments in response to market dynamics. This disciplined approach fosters financial freedom, enabling investors to align their strategies with long-term goals.

Emerging Sectors to Watch in 2025

As investors reassess their asset allocations in light of shifting market conditions, identifying emerging sectors can provide lucrative opportunities for growth.

Green technology, driven by environmental sustainability, is poised for significant expansion.

Concurrently, digital health innovations, accelerated by the pandemic, are reshaping healthcare delivery.

Both sectors not only promise financial returns but also align with a growing societal demand for sustainable and health-focused solutions.

Tactical Maneuvers for Risk Management

While market volatility poses inherent risks for investors, implementing tactical maneuvers can significantly mitigate potential losses.

Effective risk assessment is crucial, allowing investors to identify vulnerabilities.

Diversification techniques, such as allocating assets across various sectors and geographies, further enhance resilience.

Conclusion

As 2025 approaches, investors stand at a crossroads, where the path less traveled—marked by smart asset allocation and emerging sectors—offers the promise of growth amid uncertainty. Like a ship navigating turbulent waters, disciplined risk management serves as the anchor, ensuring stability in waves of market volatility. By embracing these financial strategies, investors can not only weather the storm but also harness the winds of change, steering towards a future ripe with opportunity and potential prosperity.